Identifying Schemes within Personal Care Services

When billing fraud schemes, abuse, and neglect of vulnerable Medicaid beneficiaries, there are things to look for regarding Personal Care Services (PCA) attendants (hereinafter referred to as attendants). PCA services provide aid and support for Medicaid Beneficiaries with disabilities who live independently in the community, including the elderly and others with special health care needs. Medicaid Beneficiaries would require PCA services because of activities of daily living (ADLs), observation and redirection of behaviors, and health-related procedures and tasks. Below are a few of the ADLs that a PCA may assist an individual with:

-

-

- Dressing – includes the application of appliances or wraps

- Grooming – includes primary hair care, shaving, nail care, applying cosmetics, or care of eyeglasses and hearing aids

- Bathing – includes basic personal hygiene and skincare

- Eating – includes completing the process of eating and hand washing

- Transfers – helps transfer the person from one seating or reclining area to another

- Mobility – consists of the use of a wheelchair; not including providing transportation

- Positioning – includes assistance with repositioning or turning a person for necessary care and comfort

- Toileting – includes helping a person with bowel or bladder elimination and care

-

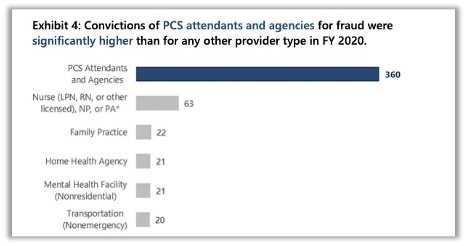

In October of 2016, the Department of Health and Human Services (DHHS) Office of Inspector General (OIG) released an Investigative Advisory on Medicaid Fraud and Patient Harm Involving Personal Care Services. With COVID-19 cases surging nationwide, Medicaid enrollment has increased drastically due to unemployment and terminated healthcare coverage. As such, health plans must prevent improper payments, detect PCA Fraud, Waste, and Abuse (FWA), and, most importantly, advocate for the beneficiaries exposed to insufficient care. Medicaid OIG reported 360 fraud convictions were related to personal care services and agencies, which comprised 47% of fraud convictions in 2020.

Billing PCA Services

PCA services are billed under the Healthcare Common Procedure Coding System (HCPCS). There are a few billing codes related to PCA services, but for this A.I. Fraud Alert, our focus will be on the T1019 and T1020:

-

- T1019- Personal care services, per 15 minutes, not for an inpatient or resident of a hospital, nursing facility, Intermediate Care Facilities with Mental Retardation (ICF/MR) or Institutes for Mental Disease (IMD), part of the individualized plan of treatment (code may not be used to identify services provided by home health aide or certified nurse assistant)

- T1020- Personal care services, per diem, not for an inpatient or resident of a hospital, nursing facility, ICF/MR, or IMD, part of the individualized plan of treatment (code may not be used to identify services provided by home health aide or certified nurse assistant)

Reviewing for FWA

Your initial step in identifying FWA in your plan is by reviewing your policies for PCA qualifications, frequency of services, and maximum unit limitations, if applicable. This is important because of variances in training requirements from state to state as outlined by CMS in the PCS-Preventing Improper Payment Booklet. See reference 1 for further details.

A PCA attendant may assist if the following criteria are met:

-

- PCA care plan describes the patient’s needed assistance

- PCA worker documents services rendered on timesheets or another agency form

- PCA worker is trained to fulfill tasks of the person in need. See the Home Health Aide Guide reference below for state-specific requirements.

What should your health plan expect regarding claims submissions for PCA services?

-

- Claims with procedure codes T1019 and T1020 were submitted by personal care contracted entities.

- Place of service typically is 12 (home)

What should your health plan consider as outlier utilization for PCA services?

-

- Excessive units for PCA services (specific to T1019 only) for a single date of service. I.E., 96 units would equate to 24 hours of PCA services. Anything above this for a single date of service would warrant further review, depending on your plan policy allowances.

- Excessive units for a single date of service or span of dates for PCA services specific to T1020

- Claims for PCA services billed by specialties other than Personal Care, or specialties designated by your plan, such as Brokerage. As per the code, PCA services should not be provided by home health aides or certified nurse assistants. Place of Service codes not equal to 12 (home) or Place of Service that represents home for your health plan.

- A higher-than-average number of units per patient within a specified timeframe. i.e.: ‘Cookie-Cutter-Billing

PCA Services: Billing Profile and Business Intelligence

| HCPCS | Per Diem | UOS Max/DOS | Place of Service | Specialty |

| T1019 | No | 96 | Home | Personal Care |

| T1020 | Yes | 1 | Home | Personal Care |

How can the Codoxo Forensic A.I. Platform assist your health plan with identifying emerging risks, trends, and other outlier claims for PCA services?

-

- The A.I. engine and detectors identify patterns, volume, and frequency across all peer groups and claims, allowing customers to identify, analyze and respond to potential FWA and efficacy issues.

- The Query tool allows users to build custom queries tailored to your organizational policy requirements.

- Existing Codoxo customers should visit their Query Library and process the “August 2021 A.I. Alert” reports to help identify schemes in PCA services.

If you would like more information or set up a demonstration of the Codoxo Forensic Platform, please contact sales@codoxo.com.